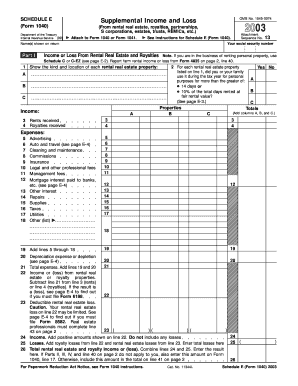

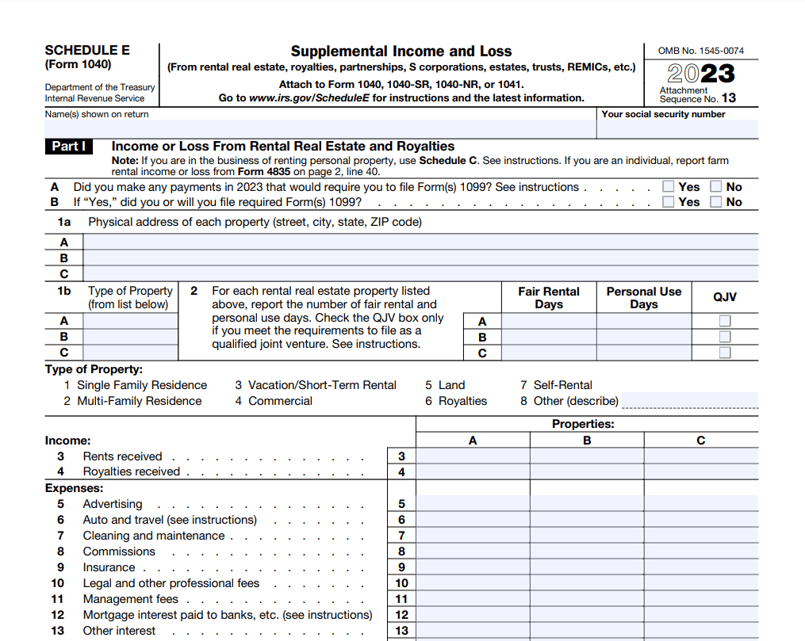

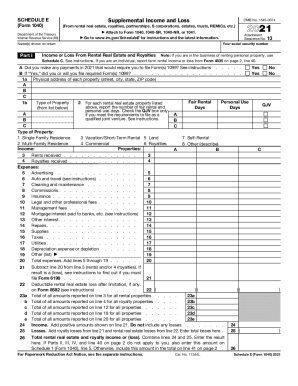

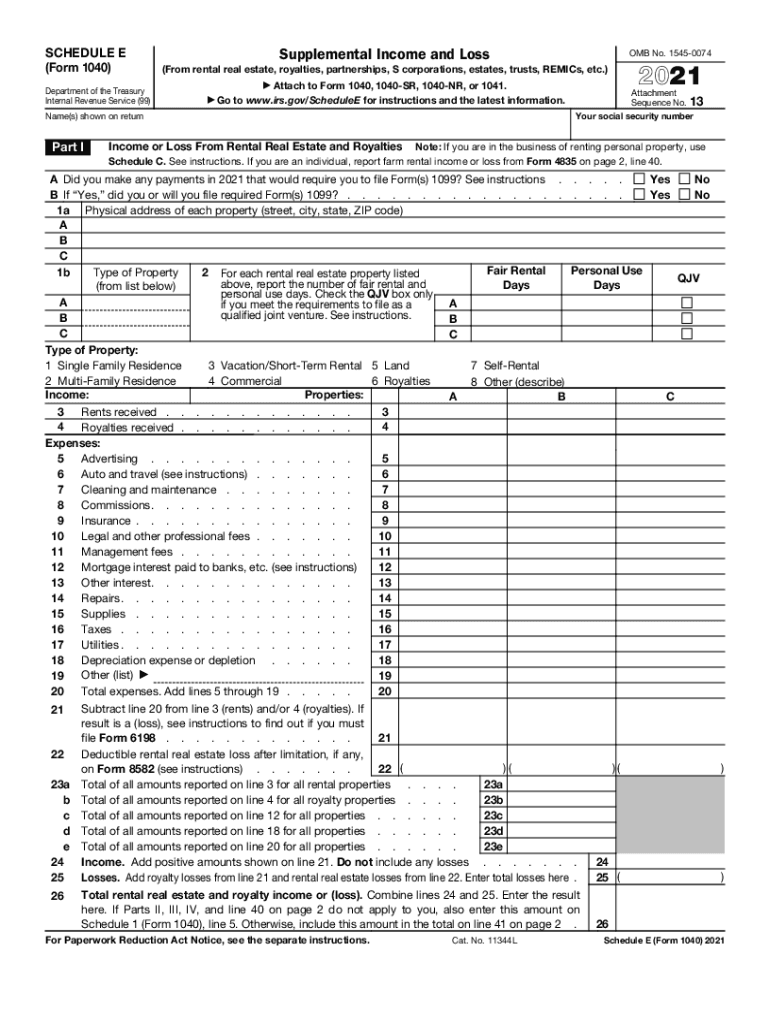

2024 Form 1040 Schedule E Download – The Internal Revenue Service requires all income from a rental property to be reported on Form 1040 Schedule E. The same form also allows you to deduct certain expenses related to the rental from . Form 1040-X should be used to correct material changes but not to fix mathematical errors. You can e-file the form if you e-filed the corresponding tax return. Otherwise, mail it in. You should .

2024 Form 1040 Schedule E Download

Source : www.pdffiller.comThe 2024 Ultimate Guide to IRS Schedule E for Real Estate Investors

Source : www.therealestatecpa.comIRS Schedule E (1040 form) | pdfFiller

Source : www.pdffiller.comForm 1040 for IRS 2024 ~ What is it? Schedule A B C D Instructions

Source : www.incometaxgujarat.orgMastering Schedule E: Tax Filing for Landlords Explained

Source : www.turbotenant.comSchedule e: Fill out & sign online | DocHub

Source : www.dochub.comThe 2024 Ultimate Guide to IRS Schedule E for Real Estate Investors

Source : www.therealestatecpa.com1040 (2023) | Internal Revenue Service

Source : www.irs.govForm 1040: U.S. Individual Tax Return Definition, Types, and Use

Source : www.investopedia.com1040 (2023) | Internal Revenue Service

Source : www.irs.gov2024 Form 1040 Schedule E Download IRS Schedule E (1040 form) | pdfFiller: Recent changes to Form 1040 mean different filing options for seniors. Get the facts about eligibility and reporting for this new version of Form 1040-SR. Recent changes to Form 1040 mean . Depending on the type of activity, you’ll report your crypto gains and losses on Form 1040 to download your transaction activity from the exchange and use this to prepare your Schedule D .

]]>

:max_bytes(150000):strip_icc()/Screenshot2023-12-15at12.57.18PM-4df7a66986cf4a1ab5cc962b78b698fd.png)