Irs Schedule Se 2024 Tax Form – Tax season has started for 2024. Find out when you need to file your taxes with the IRS and your state, and when you can expect your refund. . Ready or not, the 2024 tax filing season is here. As of January 29, the IRS is accepting and processing tax returns for 2023. The agency expects more than 128 million returns to be filed before the .

Irs Schedule Se 2024 Tax Form

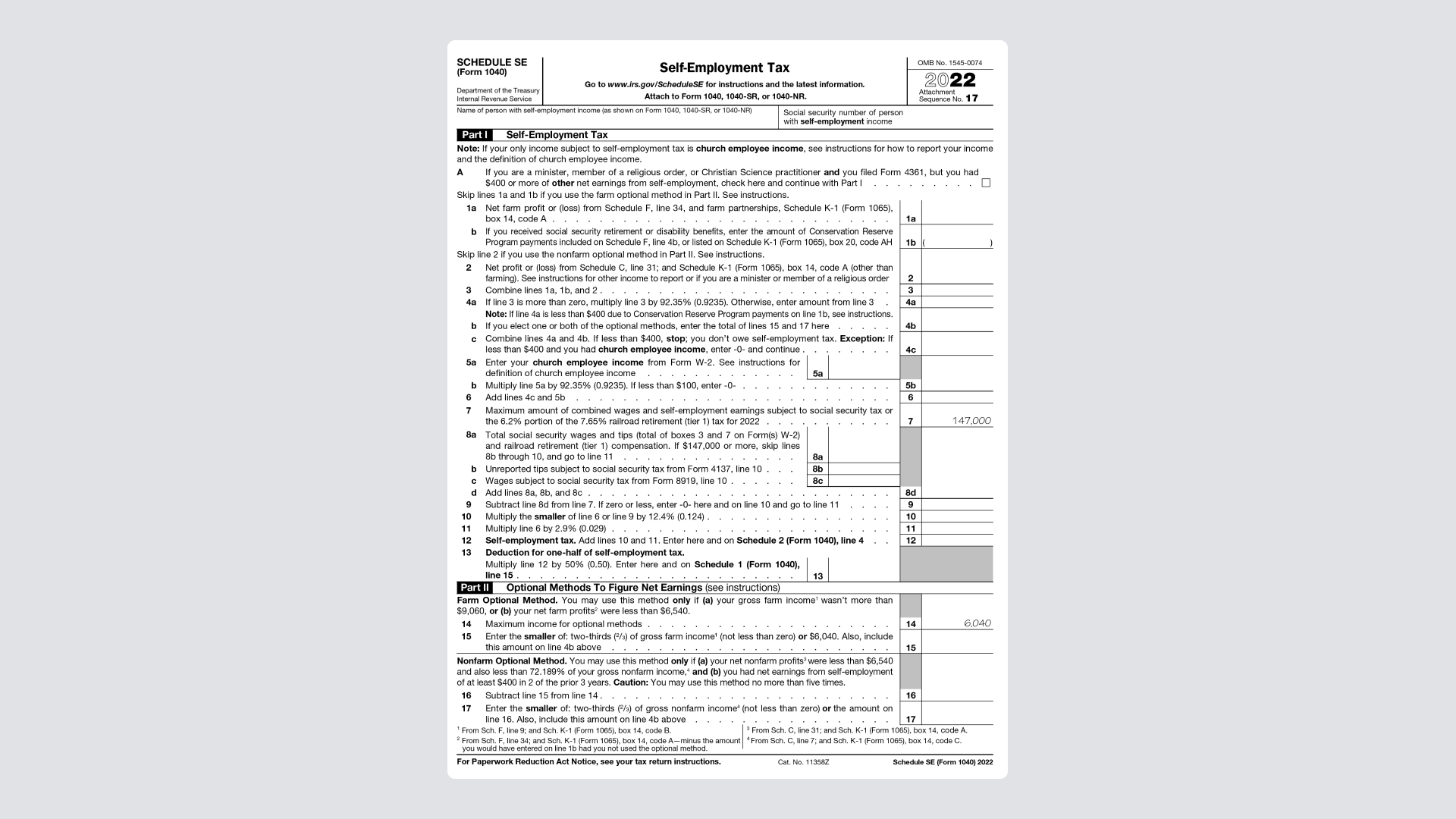

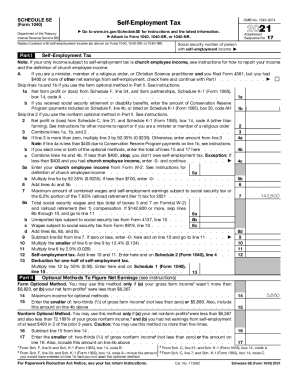

Source : www.irs.govIRS Releases Updated Schedule SE Tax Form and Instructions for

Source : www.kron4.comA Step by Step Guide to the Schedule SE Tax Form

Source : found.comAbout Schedule SE (Form 1040), Self Employment Tax | Internal

Source : www.irs.govIRS Schedule SE (1040 form) | pdfFiller

Source : www.pdffiller.comWhen To Expect My Tax Refund? IRS Tax Refund Calendar 2024

Source : thecollegeinvestor.comIRS Instruction 1040 Schedule SE 2022 2024 Fill and Sign

Source : www.uslegalforms.com1040 (2023) | Internal Revenue Service

Source : www.irs.govHow to File Schedule SE Tax Form with the IRS: Fill out & sign

Source : www.dochub.comForm 1040: U.S. Individual Tax Return Definition, Types, and Use

Source : www.investopedia.comIrs Schedule Se 2024 Tax Form 1040 (2023) | Internal Revenue Service: The IRS announced the tax brackets for the tax year 2024 in November. The agency said in a press release that the top tax rate remains 37% for individual single taxpayers with incomes greater than . If you own a small company, you may be considering structuring your business as a limited liability corporation or LLC. LLCs are seen as a favorable entity type by many business owners. The “limited .

]]>

:max_bytes(150000):strip_icc()/Screenshot2023-12-15at12.57.18PM-4df7a66986cf4a1ab5cc962b78b698fd.png)